Ok, so maybe you have to be a marketing wonk to care about all this but I find this mildly interesting.

The Online Publishers Association recently reported on online spending patterns. Umm… this was done with Comscore (makers of tracking program Relevant Knowledge…we won’t go there right now…).

There is some interesting stuff in there.

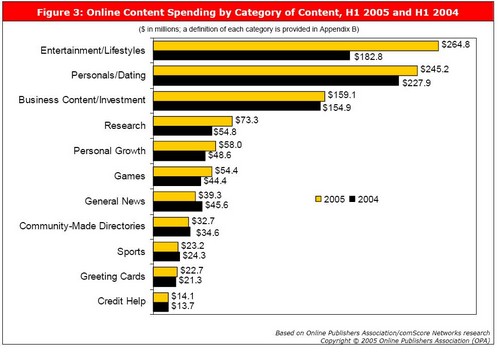

Growth in the Entertainment/Lifestyle category, driven by online music sales, has rippled through most every aspect of this report. Not only does growth in the Entertainment/Lifestyles category account for a large portion of the overall growth in online paid content spending; it accounts for the ballooning figures for single purchase content sales (now 20.1% of all revenue for paid content, up from 11.0% in 2003) as compared to subscriptions, and for the increasing percentage of all online paid content income attributed to low-price-point sales (under $5 per transaction), as compared to mid- and upper-range figures.

So paid online music sales is actually a growth area. No big news there, but perhaps it will make the Luddites feel better.

Now, if you’re wondering why you get all those popups for online dating, the answer is here. It’s a big business:

Personals/Dating remained a strong second-highest revenue producer, with online content sales of $245.2 million in H1 2005.

Conclusions of the report:

- Growth in online content spending in the first half of 2005, as in the full year 2004, was driven primarily by growth in the Entertainment/Lifestyles category as a result of online music sales.

- The two largest categories are Entertainment/Lifestyles (which includes music downloads) and Personals/Dating. The Games category also remains strong, further evidence that consumers are increasingly using the Internet for entertainment.

- Although revenue for General News is down for H1 2005, compared to H2 2004, continued strong showings by Business Content/Investment Content (the third-largest revenue-producer) and Research (up 33.8% in H1 2005 over H1 2004) indicate that consumers also readily turn to the Internet for information.

- Paid downloads of digital music are shifting the single-purchase versus subscription mix, but subscription sales continue to be the dominant pricing model for online revenue.

- Consumer penetration (the percentage of the online population that purchases online content) remains steady. Of the 171 million Americans who were online in Q2 2005, about one in nine spent money on online content purchases, so the market has plenty of room to grow.

- Average consumer spending for paid online content appears to be leveling out, showing very little change over the past three years.

PDF link here.

Alex Eckelberry

Hey, you have a great blog here! I’m definitely going to bookmark you!

Check this out! Pixel dating/friends I guess? Online pixel ads with a twist. Totally FREE, Totally Cool!

http://www.meetbypixels.com

Thank you for the informative blog

Here Is some additional Dating resources for free Dating

Find Friends

To find dates for your area please click here Dating

free online dating >>

Hundreds Of Happy People Across The Globe Have Been Successful In Finding Suitable Partners With Online dating. Thousand Of People Are Looking For A Date Today. They Are Looking For Someone. Are You One Of Them?

Lonely? Single? Married?

Are you looking for someone to FLIRT?

Looking for someone to DATE?

Find your special someone.

Date man or women you desire!

Multilingual : English – Chinese Simplified – Chinese Traditional – Dutch – French – German – Greek – Italian – Japanese – Korean – Portuguese – Russian – Spanish

Free Trial! Chat Real Time with Audio & Video Capabilities. free online dating

online dating >>

Hundreds Of Happy People Across The Globe Have Been Successful In Finding Suitable Partners With Online dating. Thousand Of People Are Looking For A Date Today. They Are Looking For Someone. Are You One Of Them?

Lonely? Single? Married?

Are you looking for someone to FLIRT?

Looking for someone to DATE?

Find your special someone.

Date man or women you desire!

Multilingual : English – Chinese Simplified – Chinese Traditional – Dutch – French – German – Greek – Italian – Japanese – Korean – Portuguese – Russian – Spanish

Free Trial! Chat Real Time with Audio & Video Capabilities. online dating