In early 1999, Brad Greenspan founded Entertainment Universe. Just a few months later, he completed a complex transaction where he raised capital from Lehman Brothers, Eisenberg Partners and others; acquired CD Universe (an online CD retailer); and went public on the OTC bulletin board by merging with Motorcycle Centers of America (an empty public shell). This all occurred on the same day, April 14th.

Within months, he continued his acquisition spree, acquiring MegaDVD.com, an online DVD retailer; entered into an agreement to buy Case’s Ladder; and signed in a letter of intent to buy Gamer’s Alliance.

Dizzy yet? Well, that’s the story of the early days of eUniverse, which later became Intermix, a subject of an entanglement with the New York AG’s office.

Brad left eUniverse in the fall of 2003 and the company later became Intermix, got into trouble with the New York AG, came to an agreement with the AG and then got bought by Rupert Murdoch.

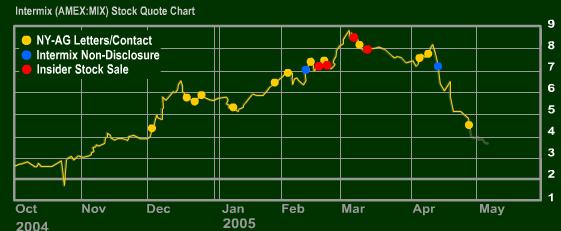

Now, Brad set up a website that is making some pretty damning allegations against certain members of the Intermix management team. He alleges that Intermix managers Brett Brewer, Adam Goldenberg, and Thomas Flahie profited by selling stock before the AG’s investigation was announced. Further, he alleges that Vantage Point Partners, an investor in Intermix, sold stock as well during roughly the same period. Vantage Point is the employer of Intermix chairman David Carlick and board member Andrew Sheehan.

(Chart from insiderstocksales.com)

He also claims that Intermix actually increased its online downloads while the AG’s office was investigating.

And he’s launched a website with slideshows to prove his point.

Is he right? Well, that’s actually hard to tell. Many executives in public companies put themselves on automatic selling programs, which sell their stock regardless of their insider knowledge. Whether or not an insider profited while in possession of material and confidential insider information is a subject of a vast amount of law and really can’t be speculated on without a thorough investigation by the SEC. In other words, don’t jump to conclusions without knowing all the facts.

Alas, I’m not a lawyer and also just don’t have the time to delve into what certainly looks like a fascinating story. If anyone else wants to get into it, go for it.

Alex Eckelberry

(Thanks Ben)